Keith Van Dell

Founding Partner | Wealth Advisor

Honest, approachable retirement planning for professionals and families.

We bring together all aspects of the pre-retiree journey—from distribution and cash flow to taxes and social security—so you can have clarity and confidence as you move toward the future you desire for yourself and your family.

About

Keith is a Founding Partner and Wealth Advisor with Waypoint Wealth Group of Woodbury, Minnesota. With over 30 years of experience in the financial services industry, he specializes in preparing clients for retirement. Keith’s approach involves performing a thorough analysis and gaining an understanding of each client’s unique financial position, investment risk comfort level, relationships, family, motivations, business, and beliefs.

Keith is a Founding Partner and Wealth Advisor with Waypoint Wealth Group of Woodbury, Minnesota. With over 30 years of experience in the financial services industry, he specializes in preparing clients for retirement. Keith’s approach involves performing a thorough analysis and gaining an understanding of each client’s unique financial position, investment risk comfort level, relationships, family, motivations, business, and beliefs.

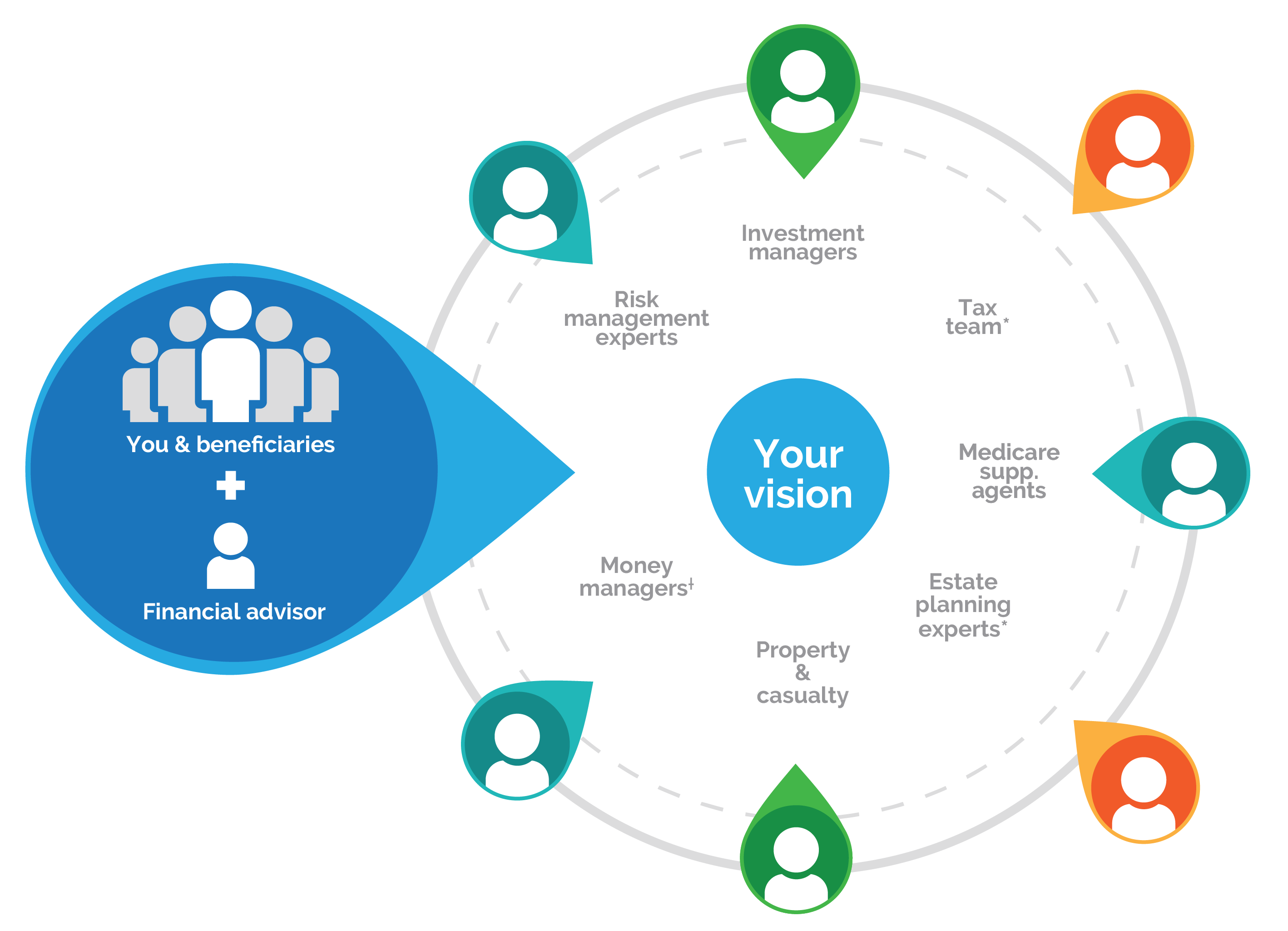

Keith’s expertise lies in developing comprehensive retirement accumulation and distribution strategies. Clients who work with Keith can look forward to having personalized asset management with full online access, multi-generational estate planning, and asset protection services all managed by one person. Keith will also work directly with client attorneys and CPAs to ensure your estate is fully understood by all parties.

Keith has been highly engaged with his community for many years, serving on multiple non-profit boards, and raising money for causes like cancer, employment displacement, and youth sports. Notably, Keith spent over 23 years coaching youth hockey, serving on the board and as president. He also served on the board and as President of the Rhino’s Foundation for several years. Rhino’s is committed to raising funds to directly impact families dealing with cancer in Pierce and Saint Croix counties in Wisconsin.

Coordinating with CPAs and attorneys

For a financial plan to be fully comprehensive, it must account for tax and legal implications. We collaborate with outside professionals with whom you have a relationship, making sure each recommendation is aligned with your overall financial picture.

Financial services

Jump to: Financial planning | Wealth management | Comprehensive retirement planning | Estate planning | Medicare Supplement guidance

Financial planning

Financial planning

Financial planning isn’t limited to you; it involves your children and all those who follow you. As such, our approach emphasizes planning for you and your entire family, as changes in one area can likely affect the other.

When working with Keith, you can expect a holistic approach to financial planning that accounts for all applicable parts of your financial situation and ensures they work in harmony together.

Wealth management

Wealth management

We coordinate your investments, insurance, and tax strategies to holistically increase your net worth.

Our investment approach aligns with your values and complements your tax strategy, enhancing your financial plan. In insurance planning, we prioritize safeguarding your assets, recommending various options, and exploring trusts and alternative solutions for added protection.

Comprehensive retirement planning

Comprehensive retirement planning

We specialize in all-inclusive retirement income planning. Using our expertise in tax-efficient retirement distribution and the nuances of Social Security income and required minimum distributions, we help you create the retirement lifestyle you choose.

Estate planning

Estate planning

If you want to make an impact beyond your lifetime, strategic estate planning can help ensure your intentions become a reality for the next generation. We leave no stone unturned as we plan for your ideal scenario, as well as alternative chains of events, ensuring that your choices for every asset are locked in, legally and fiscally. Through a multi-generational relationship approach. Keith can also help facilitate discussions and field questions to ease emotions and ensure your family members feel cared for.

Medicare Supplement guidance

Medicare Supplement guidance

Together, you and Keith can make Medicare work for you as part of your broader overall financial strategy. Using proven techniques, he can help free up money from medical expenses and simplify your healthcare choices.

Financial planning process1. Setting goals that matter to you and your familyFirst, you and Keith will uncover your and your family’s goals, needs, and dreams through discussions such as:

These questions and more help define the opportunities and challenges we will account for in your financial plan. 2. Understanding your current situationThen, our team will help gather and organize all your important financial documents to create a clear and comprehensive look at your current financial situation and how it fits together. Using time-tested processes and state-of-the-art technology, we prioritize saving time and reducing overwhelm throughout this stage, resulting in long-term peace and clarity surrounding your finances. 3. Building your custom financial planWith your starting point and your destination clearly defined, we will design a personalized financial plan with a framework for moving forward and recommendations on how to optimize your results. 4. Executing the plan and monitoring your progressWhen the plan is in motion, we will continue to provide guidance and accountability throughout your journey. As your situation changes, we may recommend updates to the plan or coach on how to stay the course. We will also work proactively in your portfolio to ensure confidence and communication in volatile or uncertain markets. |

Investment advisor representative of Cetera Advisor Networks, LLC. Securities offered through Cetera Advisor Networks LLC (doing insurance business in CA as CFGAN Insurance Agency LLC, CA Insurance Lic # 0644976), member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity. CA Insurance License #0E67126.